Allow’s be straightforward—purchasing for an insurance policies solution isn’t any individual’s notion of a great time. But in the event you’ve at any time dealt with A serious motor vehicle incident, a flooded basement, or possibly a wellbeing crisis, you know the way vital it really is. Still, the phrase "coverage solution" Appears a little bit… complex, suitable? But at its core, it just usually means finding the correct type of security for you, your stuff, and your satisfaction. It’s not about selecting a plan off a shelf. It’s about crafting a security net that actually operates to your distinctive daily life.

There's a chance you're questioning: What will make an insurance plan Alternative distinctive from just "insurance"? Fantastic dilemma. Think of it like creating your individual pizza as an alternative to ordering the regular pepperoni. An insurance solution is personalized. It brings together the proper kinds of protection—automobile, property, health, daily life, it's possible even pet or journey insurance coverage—right into a package that satisfies your preferences. The times of one-measurement-suits-all procedures are guiding us. Now, it’s all about personalization, and Truthfully, that’s a fantastic thing.

Now let’s communicate choices. There are many. Classic insurers, on-line-only vendors, brokers, insurtech startups—the record goes on. So How does one even start off to settle on? The true secret lies in being familiar with what you're in fact trying to find. Have you been hoping to guard your small business from legal responsibility? All your family members from unexpected health care expenditures? Your automobile from that wild hailstorm that will come just about every spring? The right insurance plan Alternative begins with the appropriate concerns.

At any time heard anyone say, "I don’t have to have insurance—I’m watchful"? That’s like expressing you don’t require a seatbelt because you’re a fantastic driver. Lifetime throws curveballs. It’s not about if a thing will take place, but when. A solid insurance policies solution will give you a parachute before you even know you’re falling. It’s the peaceful hero inside the track record, All set when factors go south.

An Unbiased View of Insurance Solution

Let’s break down what a comprehensive insurance Remedy may possibly appear to be. Picture you’re a freelancer. You're employed from home, drive your own private auto for conferences, and maybe provide items on the net. You’ll will need health and fitness insurance plan, property or renters coverage, vehicle protection, possibly even Skilled legal responsibility or cyber insurance policy. A personalized insurance policies solution bundles all of that into a neat package—and doubtless will save you money and anxiety.

Let’s break down what a comprehensive insurance Remedy may possibly appear to be. Picture you’re a freelancer. You're employed from home, drive your own private auto for conferences, and maybe provide items on the net. You’ll will need health and fitness insurance plan, property or renters coverage, vehicle protection, possibly even Skilled legal responsibility or cyber insurance policy. A personalized insurance policies solution bundles all of that into a neat package—and doubtless will save you money and anxiety.We all know budgets are limited. But skipping insurance policy isn’t saving—it’s gambling. The proper insurance policies Resolution matches into your spending plan when continue to providing you with serious safety. It’s not about paying for bells and whistles you don’t need to have. It’s about picking out smartly. A great company can assist you strip absent extras and focus on what truly issues for your personal Life-style.

Now, let’s look at technology. Modern insurance policies alternatives are driven by facts, AI, and buyer-centric platforms. That means less varieties, faster approvals, and quick entry to your documents. Some applications even Allow you to tweak your plan in serious-time. Forgot to add your new laptop in your renter’s coverage? Completed in a tap. These instruments are creating insurance plan much more consumer-pleasant than ever.

We live in a earth wherever we monitor our steps, keep an eye on our spending, and even time our sleep. So why wouldn’t we wish our coverage to become equally as smart? A modern insurance coverage Remedy learns from you. Some even offer bargains based upon safe driving or healthy routines. It’s not merely defense—it’s empowerment. Your plan must be just right for you, not the opposite way around.

Listed here’s a typical ache stage: statements. Not one person likes coping with them. But the correct insurance policy Option tends to make that method easy. Some platforms now use video proof, immediate deposit, and automatic verification to hurry things up. The quicker you receives a commission, the speedier everyday living goes back to standard. That’s what it’s all about—resilience, not merely coverage.

Have you at any time tried reading an insurance policies coverage front to back again? It’s like decoding ancient scrolls. But a great insurance coverage Answer demystifies the jargon. It must demonstrate points in basic English, not legalese. You are entitled to to be aware of Anything you’re paying for. And when you don’t, that’s a red flag. Clarity must normally appear typical.

Let’s speak about existence stages. The insurance policies Alternative you need at 25 is totally various from what you'll need at 50. If you're solitary, you may focus on renters and health and fitness coverage. Increase a wife or husband, probably you need everyday living insurance plan. Young children? Think education and overall health policies. Retirement? Now you’re thinking about long-phrase care or supplemental medical options. Insurance plan grows along with you—when you Enable it.

Then there’s small business. Regardless of whether you’re launching a startup or managing a spouse and children enterprise, professional coverage is often a beast of its own. Legal responsibility, home, cyber possibility, worker coverage—the list is extensive. A strong insurance Option here is more than a plan. It’s hazard administration, upcoming preparing, and comfort wrapped into a single. Think of it as your organization’s security harness.

Allow’s not overlook journey. From missed flights to shed baggage to overseas emergencies, vacation coverage generally gets overlooked. But a whole coverage Alternative consists of these times. It’s not about paranoia—it’s about freedom. Recognizing you might be coated helps you to take it easy and revel in your excursion. And isn’t that the point of touring to start with?

You know very well what’s Strange? Men and women will insure their telephone ahead of they insure their health. That’s the world we reside in. But a powerful insurance policies Remedy prioritizes what genuinely matters. Confident, safeguarding your devices is excellent—but what about you? How about All your family members? What regarding your long term? That’s wherever the value definitely lies.

Some Known Details About Insurance Solution

Some Ideas on Insurance Solution You Need To Know

Permit’s dive into customization. The top insurance coverage Answer allows you decide on deductibles, increase-on coverages, payment schedules, plus more. It’s like developing a car or truck with exactly the options you need—no additional, no a lot less. Want flood insurance policies but not earthquake? Need greater limitations for jewellery although not household furniture? It’s all achievable. You’re in control, not the insurance company.

A word about brokers: they’re not extinct, they usually can in fact be your top secret weapon. A great broker can craft an insurance coverage Resolution that you simply might not find all by yourself. They know the market, they know the loopholes, and they understand how to get you the best deal. It’s like having a GPS within the maze of insurance policies alternatives.

What about bundling? Explore here You’ve most likely witnessed the ads. But it really’s over a gimmick. Bundling various procedures into a single insurance coverage Answer can actually lessen premiums and streamline statements. Just one company, a person Call, a single Invoice—it’s simplicity in a fancy environment. And who doesn’t appreciate preserving time and expense?

Enable’s deal with the elephant while in the home: belief. Insurance policies corporations haven’t constantly experienced the most beneficial reputation. But transparency, on line assessments, and shopper-initially platforms are altering the game. A trusted coverage Option is constructed on open up interaction, truthful pricing, and quick reaction moments. If you feel like just Yet another amount, it’s the perfect time to glance somewhere else.

Sustainability is creeping into coverage, also. Environmentally friendly auto insurance policies, local climate-conscious dwelling protection, and insurers who put money into moral firms—it’s all Component of the subsequent-gen coverage Alternative. It’s not pretty much guarding your planet. It’s about safeguarding *the* world. That kind of alignment feels superior and does fantastic.

Ultimately, let’s bring it property. An insurance policy Remedy isn’t just paperwork—it’s a promise. A promise that when lifestyle throws one thing huge, you’re not by itself. Whether it’s a fender-bender, a house fire, a broken bone, or some thing it is possible to’t even think about however, you’ve acquired a program. And possessing a plan? That’s the last word peace of mind.

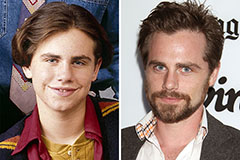

Rider Strong Then & Now!

Rider Strong Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!